Asking For Waiver Of Penalty / Waw wee: Request To Waive Penalty / Letter Request Waiver ... - Find examples of waivers in your industry.

Asking For Waiver Of Penalty / Waw wee: Request To Waive Penalty / Letter Request Waiver ... - Find examples of waivers in your industry.. (provide the bis invoice no. This money can be waived. The agency has not published a limit, but it appears to be up to $10,000 for most phone calls. As part of this tax waiver process, you are going to call the irs. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

If you want to appeal a penalty about 'indirect tax' (for example vat if hmrc sends you a penalty letter by post, use the appeal form that comes with it or follow the instructions on the letter. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent. Instructions on using irs form 843 to claim a refund or ask for an abatement of tax penalties. Do you have questions about the open enrollment waiver process? You can also show the lawyer a finished draft and ask for input.

If you want to appeal a penalty about 'indirect tax' (for example vat if hmrc sends you a penalty letter by post, use the appeal form that comes with it or follow the instructions on the letter.

Each industry has slightly different needs when it comes to waivers. To know whether you have a kra penalty, just log into your kra itax account; Here is how to apply for waiver of kra's penalties and interest using the itax system click on the apply for waiver for penalties and interests, under the page choose applicant type as taxpayer, and select tax obligation e.g. You can also show the lawyer a finished draft and ask for input. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent. The agency has not published a limit, but it appears to be up to $10,000 for most phone calls. Neglecting to take an rmd. After the delinquent date each year interest and penalties accrue on all outstanding tax liabilities. The irs will not waive the penalty on the phone. If you miss an rmd, you're subject to a 50% penalty on the amount you should have taken, and didn't. In 2001, the irs established fta to help administer the abatement of penalties consistently and fairly, reward past compliance if the representative will not override it, ask for the representative's manager. He advised us not to pay the penalty, and ask for a waiver (we have a fairly good personal reason). Ask for a waiver under 207.06 of the income tax act.

There is a monetary limit on a number of penalties that can be removed. If you want to appeal a penalty about 'indirect tax' (for example vat if hmrc sends you a penalty letter by post, use the appeal form that comes with it or follow the instructions on the letter. Where the civil penalty was already fully paid. I have been asking my landlord since april for a reduction, but was only. That said, there is no guarantee that.

They always want the request to be in writing.

By ordinance, the city may seek principal, interest and penalties for the current tax year and the prior seven tax years. The estimated tax penalty is another common penalty that. Find examples of waivers in your industry. As part of this tax waiver process, you are going to call the irs. Do you have questions about the open enrollment waiver process? Ask for a waiver under 207.06 of the income tax act. In 2017 or 2018, you retired after reaching age 62 or became disabled, and your underpayment was due to reasonable cause (and not willful neglect), or. Indicate that the charity has put in place procedures to prevent a late filing of the tax return in future years. You can also show the lawyer a finished draft and ask for input. This money can be waived. How to apply waiver kra how to pay kra penalties without money kra penalty waiver. Income tax individual or vat, then select. Ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample request waiver of penalty letter.

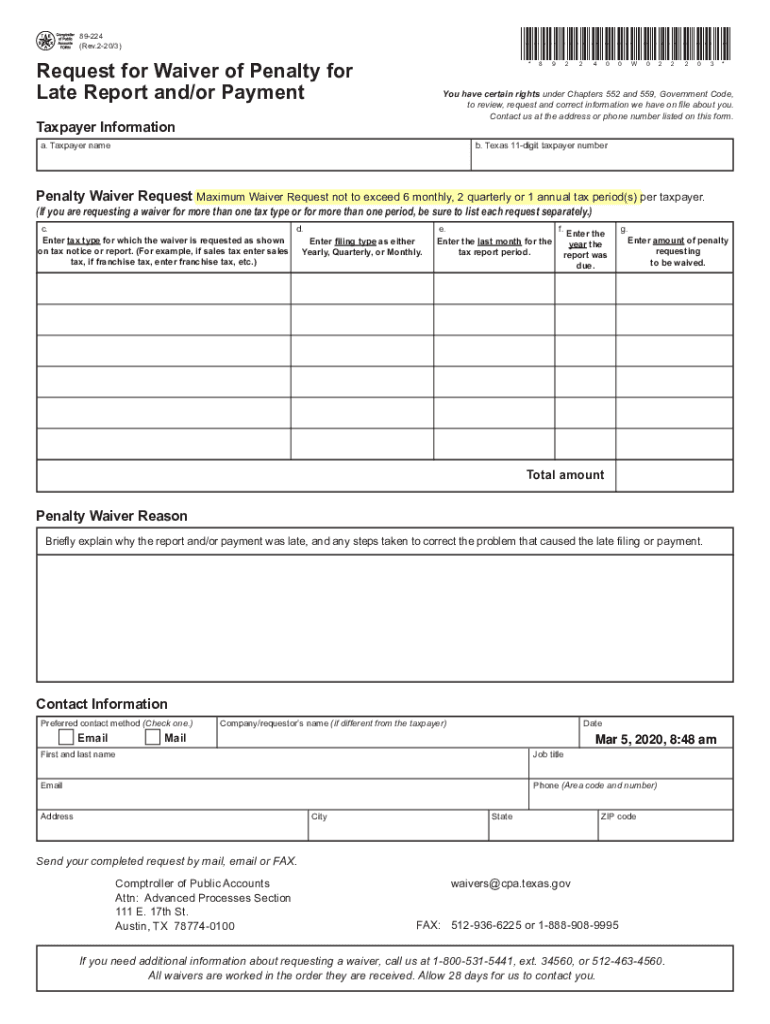

Waiver requests for late reports and payments. They always want the request to be in writing. Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes. As part of this tax waiver process, you are going to call the irs. How to apply waiver kra how to pay kra penalties without money kra penalty waiver.

A hmrc officer who was not previously involved with your penalty decision will carry out a review if you appeal.

I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent. Tax penalty waiver online form property tax. How to apply waiver kra how to pay kra penalties without money kra penalty waiver. Ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample request waiver of penalty letter. It applies to requests for waiver of civil penalties considered by the various statutes throughout chapter 105 of the general statutes establish penalties the department must assess for noncompliance. Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes. Examples include illness or death of the taxpayer or tax preparer, destruction of records by fire, flood or natural disaster, or other unusual situations that. If you are granted a waiver for your primary residence or small business, your waiver will extend the deadline to when you apply for a penalty waiver, we will ask you to include your business account number (ban) which you can find on your. Where the civil penalty was already fully paid. So, on your forms, you must tell the truth, and your. Under 'debt and enforcement', click on 'request for waiver of penalties and interests'. Waiver requests for late reports and payments. Interest is never waived unless it was an issue that was caused by fdor.

Komentar

Posting Komentar